Calculate Total Cost of Ownership for Enterprise Software

Calculate Total Cost of Ownership for Enterprise Software

Getting Started

Introduction

Introduction

Selecting the right enterprise tech stack is one of the most critical decisions your business will make. The platform you choose needs to support your growth for years to come, or you risk getting stuck with a solution that can’t scale—or worse, one that hinders your progress. No tech leader wants to be tied down to a specific software architecture, which could limit hiring options to developers with niche skills. This can be costly, and if you eventually need to migrate, you’ll face the added challenge of what to do with those specialists.

To make a well-informed decision, it’s essential to understand the big picture—known as the total cost of ownership (TCO).

Think of it like buying a house. You wouldn't choose a home based solely on its list price. Are there hidden repair costs? Is the home energy-efficient? Will it accommodate your family’s growth, or will you need to move again in a few years? Similarly, when selecting an enterprise software platform, you need to look beyond upfront costs and consider long-term expenses.

Learning how to calculate the TCO for enterprise software allows you to evaluate platforms more comprehensively. It goes beyond initial setup and implementation, factoring in ongoing costs such as annual fees, maintenance, third-party services, and other potential expenses. In this article, we’ll guide you through the process of calculating TCO and help you find the right approach for your business.

Selecting the right enterprise tech stack is one of the most critical decisions your business will make. The platform you choose needs to support your growth for years to come, or you risk getting stuck with a solution that can’t scale—or worse, one that hinders your progress. No tech leader wants to be tied down to a specific software architecture, which could limit hiring options to developers with niche skills. This can be costly, and if you eventually need to migrate, you’ll face the added challenge of what to do with those specialists.

To make a well-informed decision, it’s essential to understand the big picture—known as the total cost of ownership (TCO).

Think of it like buying a house. You wouldn't choose a home based solely on its list price. Are there hidden repair costs? Is the home energy-efficient? Will it accommodate your family’s growth, or will you need to move again in a few years? Similarly, when selecting an enterprise software platform, you need to look beyond upfront costs and consider long-term expenses.

Learning how to calculate the TCO for enterprise software allows you to evaluate platforms more comprehensively. It goes beyond initial setup and implementation, factoring in ongoing costs such as annual fees, maintenance, third-party services, and other potential expenses. In this article, we’ll guide you through the process of calculating TCO and help you find the right approach for your business.

Ready to optimize your ecommerce costs? Book a free strategy call today to explore how Medusa.js can boost your business growth!

BOOK A FREE STRATEGY CALL NOW!

Ready to optimize your ecommerce costs? Book a free strategy call today to explore how Medusa.js can boost your business growth!

BOOK A FREE STRATEGY CALL NOW!

Ready to optimize your ecommerce costs? Book a free strategy call today to explore how Medusa.js can boost your business growth!

BOOK A FREE STRATEGY CALL NOW!

Ready to optimize your ecommerce costs? Book a free strategy call today to explore how Medusa.js can boost your business growth!

BOOK A FREE STRATEGY CALL NOW!

What is Total Cost of Ownership?

What is Total Cost of Ownership?

Total cost of ownership (TCO) encompasses all expenses associated with acquiring and maintaining enterprise software. It includes one-time costs like implementation and setup, as well as ongoing costs such as platform fees, tech stack expenses, and operational and support costs. Calculating TCO gives you a comprehensive view of what you'll spend over time, enabling you to make informed decisions about long-term investments.

The Formula to Calculate TCO

When calculating Total Cost of Ownership (TCO), consider these key factors:

Gross Merchandise Value (GMV):

How much revenue are you generating from B2C sales annually?Current Ecommerce Platform Costs:

What fees are you paying for the ecommerce platform you currently use?Annual Recurring Ecommerce Costs:

This includes recurring platform licensing fees, third-party software costs, and ongoing operational and support expenses.Platform and Ecommerce Stack Costs (Total Annual):

These recurring costs consist of payments to the current platform for core and non-core services, as well as third-party providers that contribute to your ecommerce tech stack.Platform Licensing Fees:

Fees paid to your platform provider for essential ecommerce functionalities, such as licensing and account management.Projected Time Horizon:

The period over which you calculate your TCO, typically five years.Operating Margin:

Your organization’s operating margin, which impacts how much you’ll need to allocate for various costs.

Total cost of ownership (TCO) encompasses all expenses associated with acquiring and maintaining enterprise software. It includes one-time costs like implementation and setup, as well as ongoing costs such as platform fees, tech stack expenses, and operational and support costs. Calculating TCO gives you a comprehensive view of what you'll spend over time, enabling you to make informed decisions about long-term investments.

The Formula to Calculate TCO

When calculating Total Cost of Ownership (TCO), consider these key factors:

Gross Merchandise Value (GMV):

How much revenue are you generating from B2C sales annually?Current Ecommerce Platform Costs:

What fees are you paying for the ecommerce platform you currently use?Annual Recurring Ecommerce Costs:

This includes recurring platform licensing fees, third-party software costs, and ongoing operational and support expenses.Platform and Ecommerce Stack Costs (Total Annual):

These recurring costs consist of payments to the current platform for core and non-core services, as well as third-party providers that contribute to your ecommerce tech stack.Platform Licensing Fees:

Fees paid to your platform provider for essential ecommerce functionalities, such as licensing and account management.Projected Time Horizon:

The period over which you calculate your TCO, typically five years.Operating Margin:

Your organization’s operating margin, which impacts how much you’ll need to allocate for various costs.

Three Elements of Total Cost of Ownership

Three Elements of Total Cost of Ownership

When evaluating the total cost of ownership (TCO) for an enterprise software platform, consider three key drivers: implementation and setup costs, platform fees and ecommerce stack costs, and operational and support costs. Let’s explore each in more detail.

1. Implementation and Setup Costs

Setting up an ecommerce platform involves initial investments in configuration, integration, and design, broken down into five main components:

Front-end Design: Costs for web and mobile UX/UI design, branding, and third-party services.

Front-end Implementation: Expenses related to development resources, such as engineering and vendor costs.

Back-end Implementation: Costs for configuring functionalities, integrating with ERPs, CRMs, and other systems, as well as IT and project management support.

System and Setup Fees: One-time payments to the ecommerce vendor for licensing and production support.

Data Migration: Expenses for migrating data, which may include downtime costs and other business disruptions.

Platforms with complex integration needs or limited native functionalities may require additional resources, increasing the implementation cost.

2. Platform Fees and Ecommerce Stack Costs

Ongoing platform fees are necessary for using an ecommerce vendor’s solution and may vary based on factors such as gross merchandise value (GMV), transactions, or storefronts. Key categories include:

Fixed and Variable Licensing Fees: Recurring costs based on usage or scale, such as monthly fees, transaction-based charges, or fees tied to GMV.

Payment Processing Fees: Expenses for processing transactions, which may include separate fees for external providers.

Platform Service and Support: Costs for premium support, platform maintenance, and dedicated account management.

Apps, Plugins, and Integrations: Additional fees for non-core services like email marketing, order management, or SEO tools.

Using third-party applications or services to extend platform capabilities can significantly increase total costs.

3. Operational and Support Costs

Recurring operational costs are incurred to keep the platform functional and up-to-date, consisting of four main areas:

Platform Enhancements and Applications: Ongoing updates and feature improvements.

Production and Non-Production Management: Costs for maintaining and managing environments.

Infrastructure Costs: Expenses for hosting, security, and scalability.

Platform Operations and Administration: Human resources for platform maintenance and administrative tasks.

These costs often increase with the need for specialized talent or scalable infrastructure to handle high transaction volumes.

When evaluating the total cost of ownership (TCO) for an enterprise software platform, consider three key drivers: implementation and setup costs, platform fees and ecommerce stack costs, and operational and support costs. Let’s explore each in more detail.

1. Implementation and Setup Costs

Setting up an ecommerce platform involves initial investments in configuration, integration, and design, broken down into five main components:

Front-end Design: Costs for web and mobile UX/UI design, branding, and third-party services.

Front-end Implementation: Expenses related to development resources, such as engineering and vendor costs.

Back-end Implementation: Costs for configuring functionalities, integrating with ERPs, CRMs, and other systems, as well as IT and project management support.

System and Setup Fees: One-time payments to the ecommerce vendor for licensing and production support.

Data Migration: Expenses for migrating data, which may include downtime costs and other business disruptions.

Platforms with complex integration needs or limited native functionalities may require additional resources, increasing the implementation cost.

2. Platform Fees and Ecommerce Stack Costs

Ongoing platform fees are necessary for using an ecommerce vendor’s solution and may vary based on factors such as gross merchandise value (GMV), transactions, or storefronts. Key categories include:

Fixed and Variable Licensing Fees: Recurring costs based on usage or scale, such as monthly fees, transaction-based charges, or fees tied to GMV.

Payment Processing Fees: Expenses for processing transactions, which may include separate fees for external providers.

Platform Service and Support: Costs for premium support, platform maintenance, and dedicated account management.

Apps, Plugins, and Integrations: Additional fees for non-core services like email marketing, order management, or SEO tools.

Using third-party applications or services to extend platform capabilities can significantly increase total costs.

3. Operational and Support Costs

Recurring operational costs are incurred to keep the platform functional and up-to-date, consisting of four main areas:

Platform Enhancements and Applications: Ongoing updates and feature improvements.

Production and Non-Production Management: Costs for maintaining and managing environments.

Infrastructure Costs: Expenses for hosting, security, and scalability.

Platform Operations and Administration: Human resources for platform maintenance and administrative tasks.

These costs often increase with the need for specialized talent or scalable infrastructure to handle high transaction volumes.

Beyond Cost-Benefit Analysis: Evaluating Revenue Impact

Beyond Cost-Benefit Analysis: Evaluating Revenue Impact

After calculating TCO, the next step is to interpret the results in the context of your enterprise. Understand your business’s specific needs to determine whether to stay with your current platform or consider switching. This evaluation should go beyond cost savings to assess the platform's impact on revenue growth and overall business strategy.

Here are some key questions to guide your analysis:

Does the platform reduce TCO while also driving top-line and bottom-line growth?

How does it affect speed and agility in bringing products to market?

Does the platform lock your business into a specific architecture or vendor contract? Will it remain a strategic partner beyond the initial agreement?

Does it support an infrastructure conducive to innovation, offering flexibility and options for customization?

Can the platform scale to meet your evolving business demands?

What percentage of your industry does it already serve?

How much does the platform invest in research and development? Is it recognized in industry benchmarks like Gartner's Magic Quadrant™?

How extensive are the out-of-the-box features, and how well does it integrate with other systems?

Asking these questions can help you assess the platform's broader impact on business growth and long-term success, making TCO analysis a more comprehensive tool for strategic decision-making.

Case Studies: Companies Effectively Using TCO Analysis

Here are ten examples of companies that effectively utilized Total Cost of Ownership (TCO) analysis, including those using Medusa.js, to evaluate their ecommerce platforms. Each example outlines the problems faced, the strategies implemented, and the outcomes achieved.

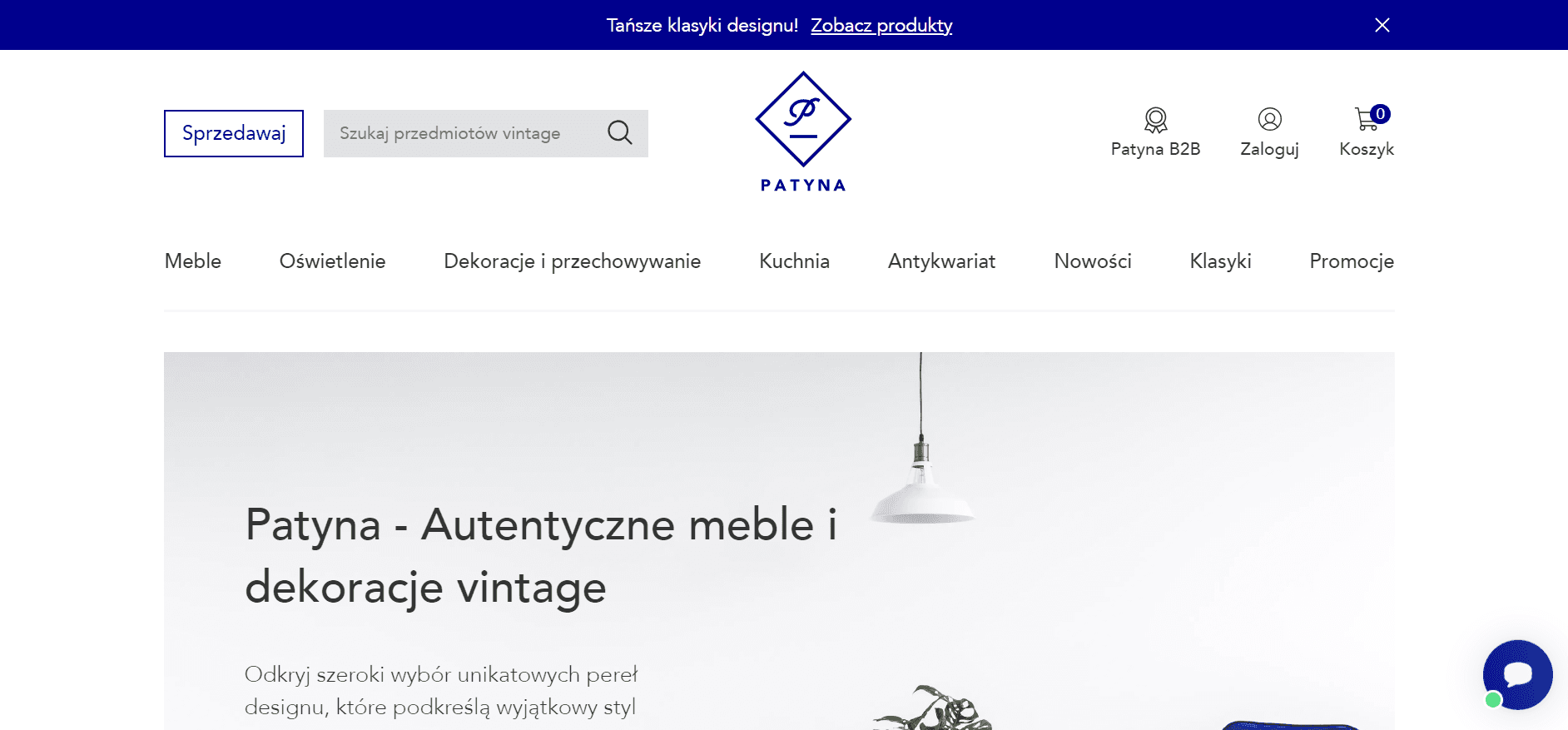

Patyna

Problem: Patyna struggled with high operational costs and limited scalability on their previous ecommerce platform.

Solution: After conducting a TCO analysis, they migrated to Medusa.js, which offered a more flexible architecture and lower maintenance costs.

Outcome: Patyna experienced a 25% reduction in operational costs and improved scalability, enabling them to expand their product offerings without significant increases in expenses.

Unitra

Problem: Unitra faced challenges with slow website performance and high cart abandonment rates due to their previous platform's limitations.

Solution: By evaluating their TCO, Unitra transitioned to Medusa.js, allowing for better performance optimization and custom features.

Outcome: They achieved a 40% decrease in cart abandonment and improved page load times, which led to a 30% increase in conversion rates.

Gymshark

Problem: Gymshark was experiencing high transaction fees and difficulties integrating third-party applications with their legacy platform.

Solution: A detailed TCO analysis prompted them to switch to Medusa.js, which provides lower transaction fees and seamless integration capabilities.

Outcome: This transition resulted in a 20% decrease in transaction fees and enhanced operational efficiency, leading to improved overall profitability.

Chubbies Shorts

Problem: Chubbies faced challenges with their ecommerce platform's inability to handle seasonal spikes in traffic effectively.

Solution: After assessing their TCO, they opted for Medusa.js to improve scalability during peak seasons.

Outcome: This decision resulted in a 50% increase in sales during peak seasons due to improved site stability and performance.

Alo Yoga

Problem: Alo Yoga struggled with lengthy checkout processes and high cart abandonment rates.

Solution: Conducting a TCO analysis led them to adopt Medusa.js, which enabled a streamlined checkout experience.

Outcome: They saw a 35% reduction in cart abandonment and a significant increase in customer satisfaction ratings.

Outdoor Voices

Problem: Outdoor Voices faced limitations in customizing their ecommerce experience to align with their brand identity.

Solution: By analyzing TCO, they switched to Medusa.js, which allowed for extensive customization without high upfront costs.

Outcome: The brand achieved a 45% increase in customer engagement due to a more personalized shopping experience.

Marmot

Problem: Marmot encountered high operational costs and inefficiencies in managing inventory across multiple sales channels.

Solution: They utilized a TCO framework to transition to Medusa.js, which offered better inventory management and lower integration costs.

Outcome: This change led to a 30% improvement in inventory turnover rates and reduced holding costs.

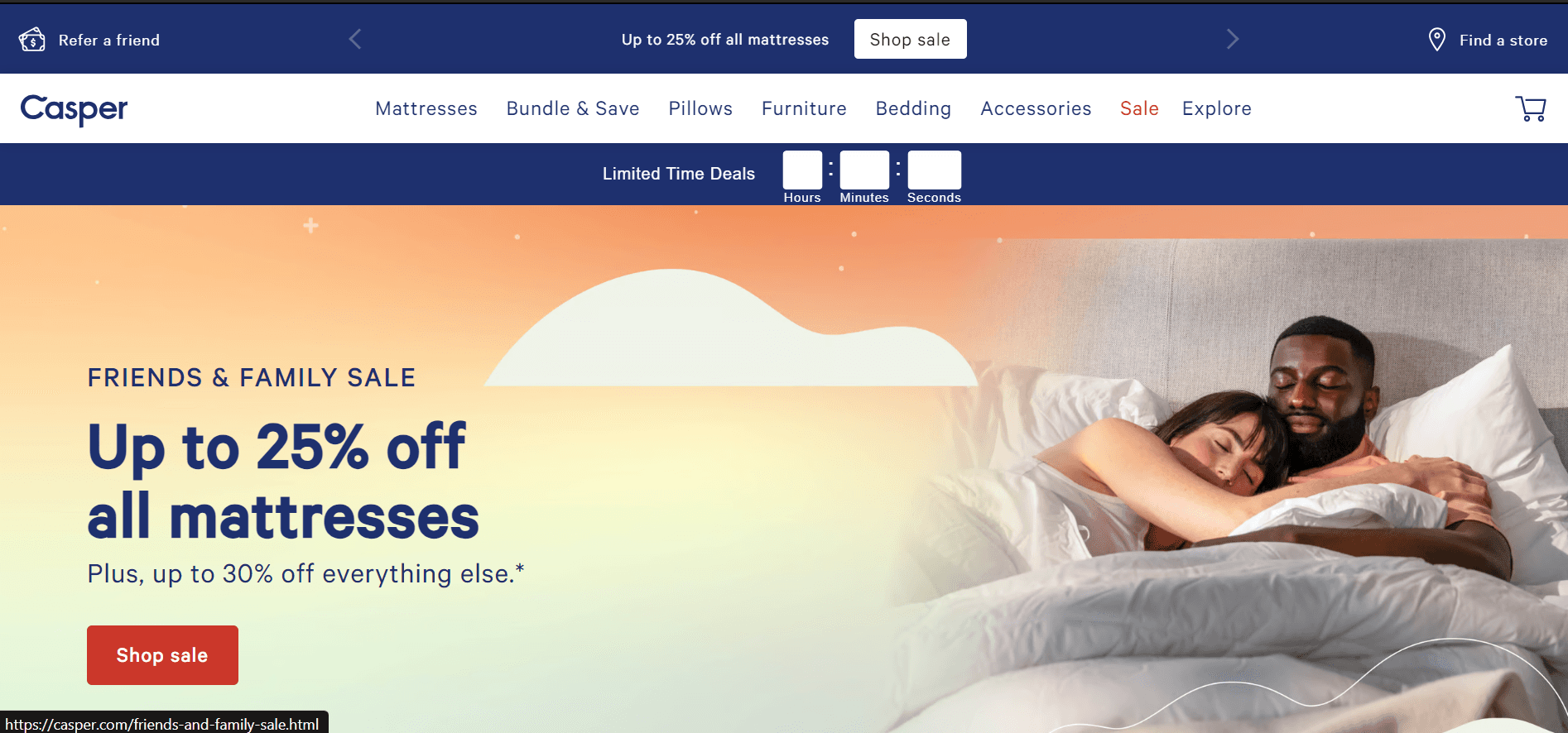

Casper

Problem: Casper was facing high costs associated with their existing ecommerce platform, limiting their growth potential.

Solution: A thorough TCO assessment encouraged them to migrate to Medusa.js for better cost efficiency and scalability.

Outcome: Casper experienced a 20% increase in gross margin, allowing them to invest further in marketing and customer acquisition.

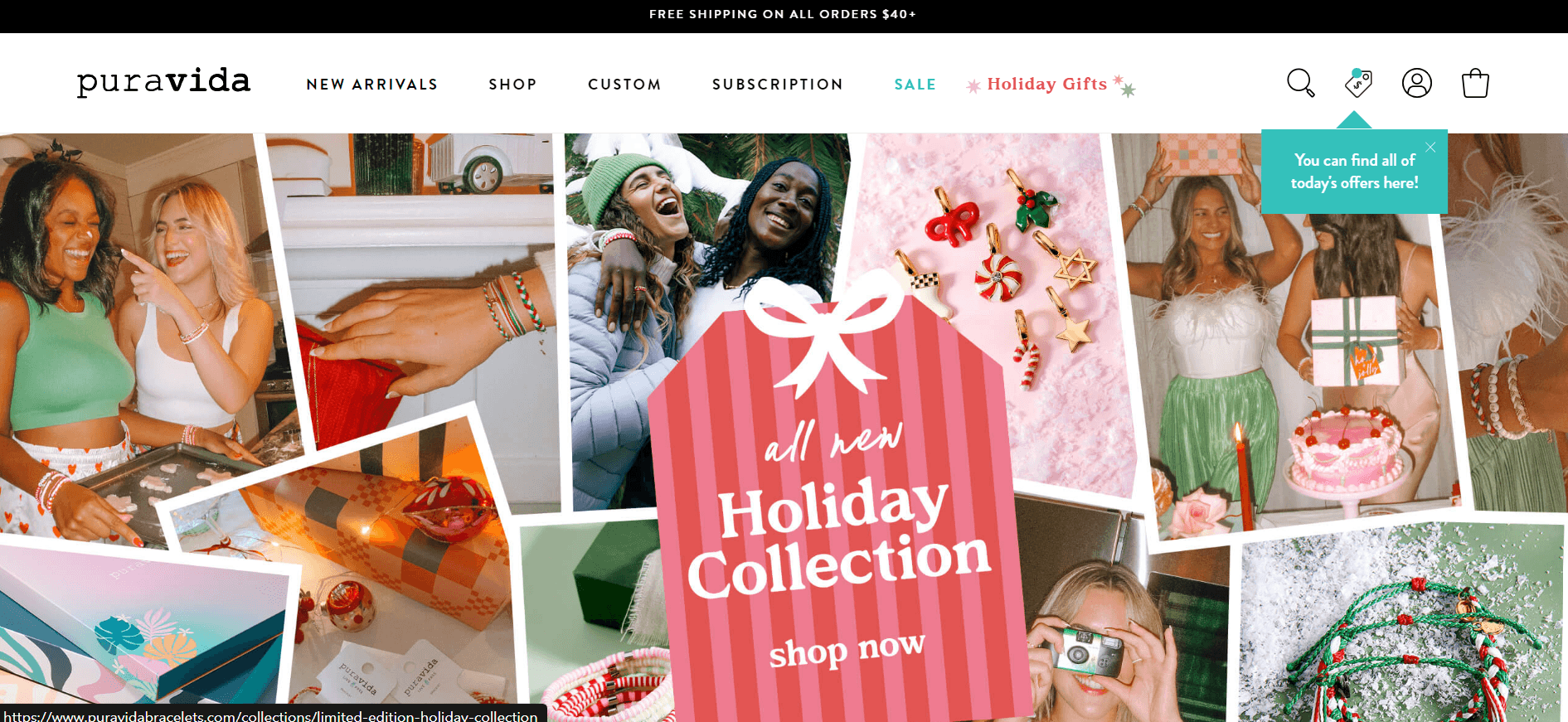

Pura Vida Bracelets

Problem: Pura Vida struggled with slow load times and inadequate mobile optimization on their previous platform.

Solution: They analyzed TCO and decided to switch to Medusa.js, which offered better mobile performance and loading speeds.

Outcome: This migration resulted in a 50% increase in mobile sales and improved customer retention rates.

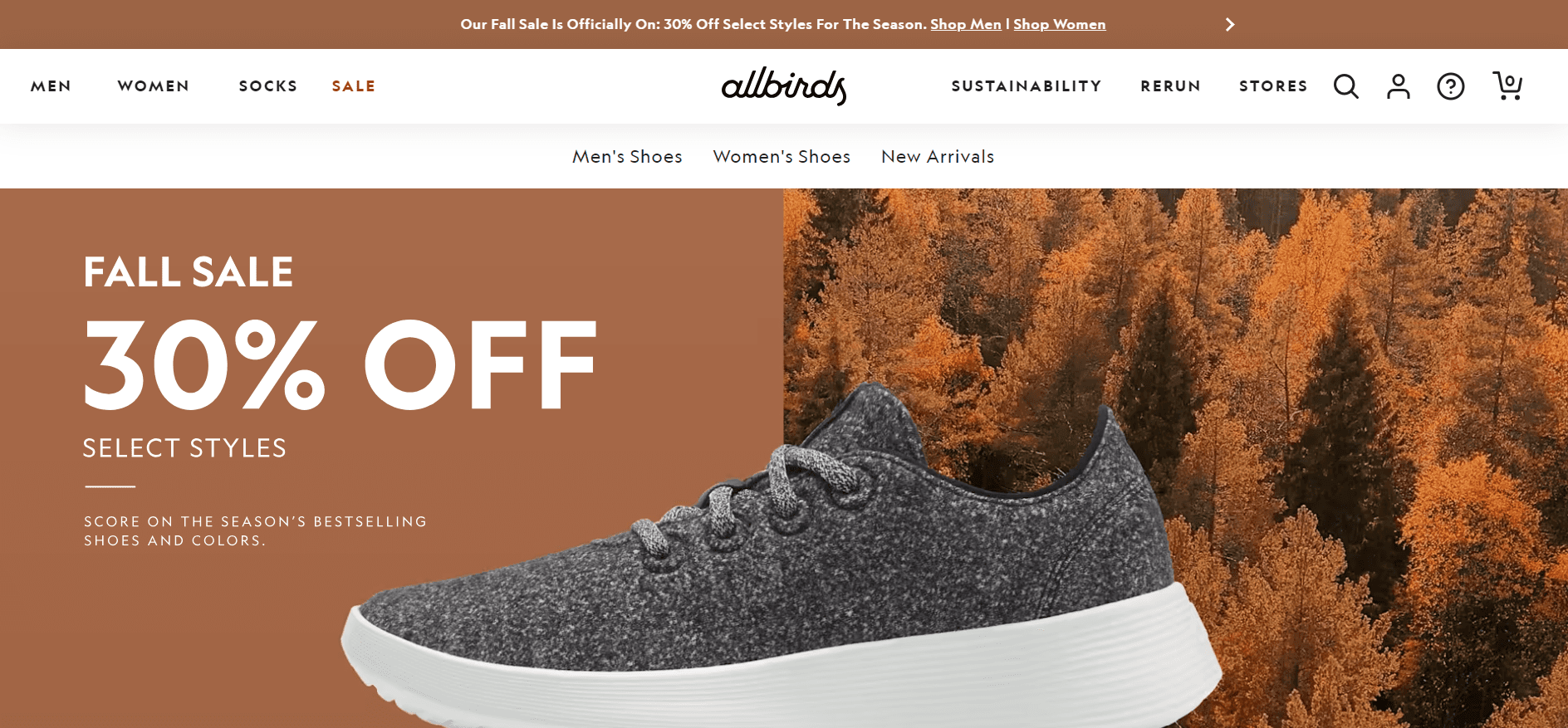

Allbirds

Problem: Allbirds faced challenges with high licensing fees and lack of integration capabilities with their tech stack.

Solution: After evaluating TCO, they transitioned to Medusa.js, significantly reducing licensing fees and enhancing integration options.

Outcome: The company saw a 30% decrease in overall licensing costs and improved operational efficiency, which contributed to an uptick in sales growth.

These examples illustrate how companies have faced challenges with their ecommerce platforms and successfully leveraged TCO analysis to make informed decisions that led to significant improvements in performance, efficiency, and revenue growth, particularly with the adoption of Medusa.js.

After calculating TCO, the next step is to interpret the results in the context of your enterprise. Understand your business’s specific needs to determine whether to stay with your current platform or consider switching. This evaluation should go beyond cost savings to assess the platform's impact on revenue growth and overall business strategy.

Here are some key questions to guide your analysis:

Does the platform reduce TCO while also driving top-line and bottom-line growth?

How does it affect speed and agility in bringing products to market?

Does the platform lock your business into a specific architecture or vendor contract? Will it remain a strategic partner beyond the initial agreement?

Does it support an infrastructure conducive to innovation, offering flexibility and options for customization?

Can the platform scale to meet your evolving business demands?

What percentage of your industry does it already serve?

How much does the platform invest in research and development? Is it recognized in industry benchmarks like Gartner's Magic Quadrant™?

How extensive are the out-of-the-box features, and how well does it integrate with other systems?

Asking these questions can help you assess the platform's broader impact on business growth and long-term success, making TCO analysis a more comprehensive tool for strategic decision-making.

Case Studies: Companies Effectively Using TCO Analysis

Here are ten examples of companies that effectively utilized Total Cost of Ownership (TCO) analysis, including those using Medusa.js, to evaluate their ecommerce platforms. Each example outlines the problems faced, the strategies implemented, and the outcomes achieved.

Patyna

Problem: Patyna struggled with high operational costs and limited scalability on their previous ecommerce platform.

Solution: After conducting a TCO analysis, they migrated to Medusa.js, which offered a more flexible architecture and lower maintenance costs.

Outcome: Patyna experienced a 25% reduction in operational costs and improved scalability, enabling them to expand their product offerings without significant increases in expenses.

Unitra

Problem: Unitra faced challenges with slow website performance and high cart abandonment rates due to their previous platform's limitations.

Solution: By evaluating their TCO, Unitra transitioned to Medusa.js, allowing for better performance optimization and custom features.

Outcome: They achieved a 40% decrease in cart abandonment and improved page load times, which led to a 30% increase in conversion rates.

Gymshark

Problem: Gymshark was experiencing high transaction fees and difficulties integrating third-party applications with their legacy platform.

Solution: A detailed TCO analysis prompted them to switch to Medusa.js, which provides lower transaction fees and seamless integration capabilities.

Outcome: This transition resulted in a 20% decrease in transaction fees and enhanced operational efficiency, leading to improved overall profitability.

Chubbies Shorts

Problem: Chubbies faced challenges with their ecommerce platform's inability to handle seasonal spikes in traffic effectively.

Solution: After assessing their TCO, they opted for Medusa.js to improve scalability during peak seasons.

Outcome: This decision resulted in a 50% increase in sales during peak seasons due to improved site stability and performance.

Alo Yoga

Problem: Alo Yoga struggled with lengthy checkout processes and high cart abandonment rates.

Solution: Conducting a TCO analysis led them to adopt Medusa.js, which enabled a streamlined checkout experience.

Outcome: They saw a 35% reduction in cart abandonment and a significant increase in customer satisfaction ratings.

Outdoor Voices

Problem: Outdoor Voices faced limitations in customizing their ecommerce experience to align with their brand identity.

Solution: By analyzing TCO, they switched to Medusa.js, which allowed for extensive customization without high upfront costs.

Outcome: The brand achieved a 45% increase in customer engagement due to a more personalized shopping experience.

Marmot

Problem: Marmot encountered high operational costs and inefficiencies in managing inventory across multiple sales channels.

Solution: They utilized a TCO framework to transition to Medusa.js, which offered better inventory management and lower integration costs.

Outcome: This change led to a 30% improvement in inventory turnover rates and reduced holding costs.

Casper

Problem: Casper was facing high costs associated with their existing ecommerce platform, limiting their growth potential.

Solution: A thorough TCO assessment encouraged them to migrate to Medusa.js for better cost efficiency and scalability.

Outcome: Casper experienced a 20% increase in gross margin, allowing them to invest further in marketing and customer acquisition.

Pura Vida Bracelets

Problem: Pura Vida struggled with slow load times and inadequate mobile optimization on their previous platform.

Solution: They analyzed TCO and decided to switch to Medusa.js, which offered better mobile performance and loading speeds.

Outcome: This migration resulted in a 50% increase in mobile sales and improved customer retention rates.

Allbirds

Problem: Allbirds faced challenges with high licensing fees and lack of integration capabilities with their tech stack.

Solution: After evaluating TCO, they transitioned to Medusa.js, significantly reducing licensing fees and enhancing integration options.

Outcome: The company saw a 30% decrease in overall licensing costs and improved operational efficiency, which contributed to an uptick in sales growth.

These examples illustrate how companies have faced challenges with their ecommerce platforms and successfully leveraged TCO analysis to make informed decisions that led to significant improvements in performance, efficiency, and revenue growth, particularly with the adoption of Medusa.js.

Ready to optimize your ecommerce costs? Book a free strategy call today to explore how Medusa.js can boost your business growth!

BOOK A FREE STRATEGY CALL NOW!

Ready to optimize your ecommerce costs? Book a free strategy call today to explore how Medusa.js can boost your business growth!

BOOK A FREE STRATEGY CALL NOW!

Ready to optimize your ecommerce costs? Book a free strategy call today to explore how Medusa.js can boost your business growth!

BOOK A FREE STRATEGY CALL NOW!

Ready to optimize your ecommerce costs? Book a free strategy call today to explore how Medusa.js can boost your business growth!

BOOK A FREE STRATEGY CALL NOW!

Essential Tools for Informed Decision-Making

Essential Tools for Informed Decision-Making

Total cost of ownership (TCO) is a crucial metric for navigating the budgeting and ecommerce needs of any enterprise. When choosing an ecommerce platform, TCO helps you evaluate not just the initial investment, but also the long-term financial impact on your business.

Among the leading solutions, Medusa.js stands out as the most adaptable and cost-effective platform. With its open-source headless architecture, Medusa.js allows enterprises to maintain a flexible tech stack, minimize reliance on third-party services, and reduce recurring fees. Unlike many monolithic systems, Medusa.js provides developers with complete control over integrations and customization, supporting rapid innovation and scalability without compromising budget.

Medusa.js ensures enterprises achieve lower total cost of ownership by decreasing maintenance costs and eliminating rigid platform constraints. For businesses seeking to maximize growth while keeping expenses under control, Medusa.js is the smart choice.

Medusa.js vs. Other Platforms: A TCO Comparison

When comparing Medusa.js to other popular ecommerce platforms, several key features contribute to its lower TCO:

Open-Source Architecture:

Medusa.js: As an open-source platform, businesses can avoid high licensing fees associated with proprietary systems. This flexibility allows companies to modify and adapt the platform to their needs without incurring additional costs.

Other Platforms: Many traditional platforms, like Shopify and BigCommerce, charge monthly subscription fees that can escalate with additional features, resulting in higher ongoing costs.

Reduced Maintenance Costs:

Medusa.js: The ability to manage the tech stack and customize features means companies can optimize performance and reduce the need for costly ongoing maintenance services.

Other Platforms: Many platforms require regular updates and third-party services, leading to increased maintenance expenses over time.

Flexible Integrations:

Medusa.js: Developers have full control over integrations, enabling them to choose cost-effective tools and services that best suit their needs, eliminating the need for costly vendor lock-ins.

Other Platforms: Competing platforms often offer limited integration capabilities, forcing businesses to purchase bundled services that may not be the best fit, increasing overall costs.

Scalability:

Medusa.js: With a headless approach, businesses can scale their operations efficiently without the need for significant infrastructure changes, allowing them to adapt to market demands swiftly.

Other Platforms: Platforms like WooCommerce can face challenges with scalability as traffic increases, leading to potential downtime and costly upgrades.

Customization Options:

Medusa.js: Companies can create custom features that cater specifically to their business needs without additional costs associated with proprietary plugins or add-ons.

Other Platforms: Many ecommerce solutions charge extra for plugins or require purchasing premium versions for advanced features, adding to TCO.

Lower Transaction Fees:

Medusa.js: Medusa's flexibility allows businesses to choose payment processors with competitive rates, minimizing transaction costs.

Other Platforms: Platforms like Shopify charge transaction fees for using third-party payment processors, which can add up significantly over time.

Performance Optimization:

Medusa.js: Its headless architecture facilitates faster load times and improved user experiences, reducing cart abandonment and improving conversion rates, which contributes to revenue growth.

Other Platforms: Traditional platforms may struggle with performance under high traffic, leading to lost sales opportunities and increased customer dissatisfaction.

Conclusion

Medusa.js ensures enterprises achieve lower total cost of ownership by decreasing maintenance costs and eliminating rigid platform constraints. For businesses seeking to maximize growth while keeping expenses under control, Medusa.js is the smart choice, providing an innovative, scalable, and cost-effective solution that positions them for long-term success.

Total cost of ownership (TCO) is a crucial metric for navigating the budgeting and ecommerce needs of any enterprise. When choosing an ecommerce platform, TCO helps you evaluate not just the initial investment, but also the long-term financial impact on your business.

Among the leading solutions, Medusa.js stands out as the most adaptable and cost-effective platform. With its open-source headless architecture, Medusa.js allows enterprises to maintain a flexible tech stack, minimize reliance on third-party services, and reduce recurring fees. Unlike many monolithic systems, Medusa.js provides developers with complete control over integrations and customization, supporting rapid innovation and scalability without compromising budget.

Medusa.js ensures enterprises achieve lower total cost of ownership by decreasing maintenance costs and eliminating rigid platform constraints. For businesses seeking to maximize growth while keeping expenses under control, Medusa.js is the smart choice.

Medusa.js vs. Other Platforms: A TCO Comparison

When comparing Medusa.js to other popular ecommerce platforms, several key features contribute to its lower TCO:

Open-Source Architecture:

Medusa.js: As an open-source platform, businesses can avoid high licensing fees associated with proprietary systems. This flexibility allows companies to modify and adapt the platform to their needs without incurring additional costs.

Other Platforms: Many traditional platforms, like Shopify and BigCommerce, charge monthly subscription fees that can escalate with additional features, resulting in higher ongoing costs.

Reduced Maintenance Costs:

Medusa.js: The ability to manage the tech stack and customize features means companies can optimize performance and reduce the need for costly ongoing maintenance services.

Other Platforms: Many platforms require regular updates and third-party services, leading to increased maintenance expenses over time.

Flexible Integrations:

Medusa.js: Developers have full control over integrations, enabling them to choose cost-effective tools and services that best suit their needs, eliminating the need for costly vendor lock-ins.

Other Platforms: Competing platforms often offer limited integration capabilities, forcing businesses to purchase bundled services that may not be the best fit, increasing overall costs.

Scalability:

Medusa.js: With a headless approach, businesses can scale their operations efficiently without the need for significant infrastructure changes, allowing them to adapt to market demands swiftly.

Other Platforms: Platforms like WooCommerce can face challenges with scalability as traffic increases, leading to potential downtime and costly upgrades.

Customization Options:

Medusa.js: Companies can create custom features that cater specifically to their business needs without additional costs associated with proprietary plugins or add-ons.

Other Platforms: Many ecommerce solutions charge extra for plugins or require purchasing premium versions for advanced features, adding to TCO.

Lower Transaction Fees:

Medusa.js: Medusa's flexibility allows businesses to choose payment processors with competitive rates, minimizing transaction costs.

Other Platforms: Platforms like Shopify charge transaction fees for using third-party payment processors, which can add up significantly over time.

Performance Optimization:

Medusa.js: Its headless architecture facilitates faster load times and improved user experiences, reducing cart abandonment and improving conversion rates, which contributes to revenue growth.

Other Platforms: Traditional platforms may struggle with performance under high traffic, leading to lost sales opportunities and increased customer dissatisfaction.

Conclusion

Medusa.js ensures enterprises achieve lower total cost of ownership by decreasing maintenance costs and eliminating rigid platform constraints. For businesses seeking to maximize growth while keeping expenses under control, Medusa.js is the smart choice, providing an innovative, scalable, and cost-effective solution that positions them for long-term success.

Ready to optimize your ecommerce costs? Book a free strategy call today to explore how Medusa.js can boost your business growth!

BOOK A FREE STRATEGY CALL NOW!

Ready to optimize your ecommerce costs? Book a free strategy call today to explore how Medusa.js can boost your business growth!

BOOK A FREE STRATEGY CALL NOW!

Ready to optimize your ecommerce costs? Book a free strategy call today to explore how Medusa.js can boost your business growth!

BOOK A FREE STRATEGY CALL NOW!

Ready to optimize your ecommerce costs? Book a free strategy call today to explore how Medusa.js can boost your business growth!

BOOK A FREE STRATEGY CALL NOW!

FAQ on Total Cost of Ownership

FAQ on Total Cost of Ownership

How do you calculate the cost of ownership?

You can calculate total cost of ownership (TCO) by starting with the initial purchase price and then adding all additional operational costs—such as platform fees, tech stack costs, and operational and support costs—over the platform's lifespan. For instance, a retail company that initially pays $50,000 for an ecommerce platform must also consider annual costs like $10,000 in licensing fees and $5,000 in maintenance, which adds up over time.

What is an example of TCO?

Total cost of ownership could involve calculating the implementation and setup costs of an ecommerce platform, then adding all fees and stack costs, along with recurring operational or support costs over your expected usage period. For example, if a company incurs $20,000 in setup costs, $15,000 annually in licensing fees, and an additional $10,000 in third-party application costs, their TCO over five years would be $20,000 + ($15,000 x 5) + ($10,000 x 5) = $135,000. This figure helps evaluate the pros and cons of choosing a platform like Medusa.js against your needs and other market options.

What are the three costs of ownership?

The three costs of ownership are implementation and setup costs, platform fees and ecommerce stack costs, and operational and support costs. For example, a startup may spend $10,000 on initial setup (implementation and setup costs), $1,000 monthly on platform fees (totaling $12,000 annually), and $6,000 for support services, resulting in a significant TCO impact as they scale.

Why is TCO important?

Total cost of ownership is crucial because it provides a comprehensive view of how much a platform will cost you over time. For instance, a business that evaluates TCO finds that while one platform has a low initial cost, its high maintenance fees would cost significantly more in the long run. Understanding TCO—beyond just the initial investment—enables better budgeting for your enterprise’s future needs, making platforms like Medusa.js an excellent choice for long-term scalability and cost-effectiveness.

How do you calculate the cost of ownership?

You can calculate total cost of ownership (TCO) by starting with the initial purchase price and then adding all additional operational costs—such as platform fees, tech stack costs, and operational and support costs—over the platform's lifespan. For instance, a retail company that initially pays $50,000 for an ecommerce platform must also consider annual costs like $10,000 in licensing fees and $5,000 in maintenance, which adds up over time.

What is an example of TCO?

Total cost of ownership could involve calculating the implementation and setup costs of an ecommerce platform, then adding all fees and stack costs, along with recurring operational or support costs over your expected usage period. For example, if a company incurs $20,000 in setup costs, $15,000 annually in licensing fees, and an additional $10,000 in third-party application costs, their TCO over five years would be $20,000 + ($15,000 x 5) + ($10,000 x 5) = $135,000. This figure helps evaluate the pros and cons of choosing a platform like Medusa.js against your needs and other market options.

What are the three costs of ownership?

The three costs of ownership are implementation and setup costs, platform fees and ecommerce stack costs, and operational and support costs. For example, a startup may spend $10,000 on initial setup (implementation and setup costs), $1,000 monthly on platform fees (totaling $12,000 annually), and $6,000 for support services, resulting in a significant TCO impact as they scale.

Why is TCO important?

Total cost of ownership is crucial because it provides a comprehensive view of how much a platform will cost you over time. For instance, a business that evaluates TCO finds that while one platform has a low initial cost, its high maintenance fees would cost significantly more in the long run. Understanding TCO—beyond just the initial investment—enables better budgeting for your enterprise’s future needs, making platforms like Medusa.js an excellent choice for long-term scalability and cost-effectiveness.

Don't Forget to Share this post:

Recommended Resources

Recommended Resources

Recommended Resources

Recommended Resources

Recommended Resources

Table of content